REAL ESTATE INCLUDED

Cook County, IL

$3,400,000

REAL ESTATE INCLUDED

Cook County, IL

$3,400,000

Pine River, MN

$299,000

Port Saint Lucie, FL

$359,000

Jefferson County, LA

$250,000

REAL ESTATE INCLUDED

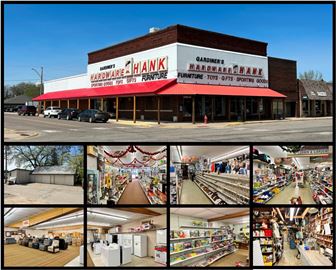

Tyler, TX

$2,500,000

Rock Island County, IL

$625,000

Okatie, SC

$120,000

Birmingham, AL

$75,000

Gregg County, TX

$157,000

REAL ESTATE INCLUDED

Louisiana

$1,500,000

Raleigh, NC

$75,000

Kenner, LA

$65,000

Jefferson County, OR

$1,950,000

New Jersey

$4,700,000

REAL ESTATE INCLUDED

Washington

$3,890,000

REAL ESTATE INCLUDED

Iowa

$2,078,500

Aaron Muller

Advantage Commercial Brokers

Serving King County, WA

Advantage Commercial Brokers is a boutique brokerage firm that specializes in selling privately held companies in Nevada and Washington State. Over the last 20 years, we have successfully sold companies in just about every industry imaginable including service, manufacturing, wholesale, distribution, e-commerce, automotive, construction, industrial, professional practice, retail, technology, education, franchises, hospitality, and more. Why choose Advantage Commercial Brokers? * Direct representation by the most experienced brokers. Unlike hiring a larger firm that touts its company experience only to find that you are assigned a junior broker or that your company may be too small to deserve much attention amongst its large accounts, most clients at Advantage Commercial Brokers are represented directly by the President of Advantage Commercial Brokers with decades of business brokerage experience. * Business ownership experience. Unlike most business brokers in the industry who are salespeople looking to earn a commission, the principals of Advantage Commercial Brokers are successful business owners themselves. Aaron Muller, President of Advantage Commercial Brokers, currently owns multiple companies that run without him in addition to recently selling one of his companies in excess of $50 million. Aaron represents business sellers as a business broker not because he needs the commission, but because he wants to help his fellow entrepreneurs exit the business smoothly and profitably. Business buyer and sellers count on Aaron for his objective and expert advice. * Specialty. Selling privately held companies is all we do. We do not sell houses, and we do not sell commercial real estate unless it is attached to a business sale. We know how to sell a business inside and out.

Wilkes Barre, PA

$60,000

Scranton, PA

$1,500,000

Long Beach Township, NJ

$75,000

Broward County, FL

$255,000

New Haven County, CT

$650,000

Dayton, OH

$48,000

Old Bridge, NJ

$299,999

Watertown, CT

$14,500

Wilkes Barre, PA

$60,000

Denton County, TX

$220,000

Tempe, AZ

$58,000

REAL ESTATE INCLUDED

East Brookfield, MA

$500,000

Clarence, NY

$349,000

Belvidere, NJ

$120,000

Brevard County, FL

$400,000

REAL ESTATE INCLUDED

Atlanta, GA

$2,200,000

REAL ESTATE INCLUDED

Oakwood, GA

$6,200,000

Worcester County, MA

$599,000

Worcester County, MA

$899,000

Sunrise, FL

$189,000

Retail businesses are crucial to the local economy, offering a wide variety of goods, including bike shops, flower shops, convenience stores, liquor stores, and clothing stores, among others. They are an excellent opportunity for small, local business owners to establish profitable enterprises while contributing to the economic health of their communities. With the ability to serve as both profitable ventures and community cornerstones, retail businesses remain a vital component of local commerce.

If you are looking to buy or sell a retail business, it helps to have some context on the market, and to understand how they are valued. Below, we have aggregated financial data from current and recent listings to provide some benchmarks on valuation and financial performance of retail businesses. All data is based on broker and business owner provided financial information.

Market Overview

|

Number of Businesses Analyzed |

4,722 |

|

Median Asking Price |

$300,000 |

|

Median Reported Revenue |

$600,000 |

|

Median Reported Earnings |

$133,000 |

|

Financials based on businesses that listed an asking price, annual revenue, and seller's discretionary earnings. |

|

Retail Business Valuation Multiples

|

Range |

Revenue |

Earnings (SDE) |

|

Lower Quartile |

0.37 |

1.79 |

|

Median |

0.56 |

2.53 |

|

Upper Quartile |

0.85 |

3.50 |

|

Revenue and earnings multiples based on reported revenue, seller's discretionary earnings, and asking price. |

||

Read the Report:

Retail Business Industry Valuation Report

Popular Retail Business Categories

FAQs

How much does it cost to buy a retail business?

The median asking price for a retail business is approximately $300,000. However, this can vary significantly depending on the size, location, and financial performance of the store or shop.

How much do local retail business owners earn?

On average, store owners report median annual sales of $600,000 and annual owner earnings of $133,000. These figures are based on businesses that have listed their annual revenue and seller's discretionary earnings.

How do I value a retail business?

Valuing a retail business involves considering several factors, including annual revenue, profit margins, location, real estate, and market conditions. Brokers, business owners, and business buyers will typically rely on valuation multiples to gauge business value relative to similar businesses in the market. Retail revenue multiples typically range from 0.37 to 0.85, with the median at 0.56. Earnings multiples range from 1.79 to 3.50, with the median at 2.53. These values suggest a typical local retail business will sell for around 0.56 times its annual revenue, and 2.53 times its annual owner’s earnings.

More for Business Buyers:

Set Up Alerts and Notifications

Business Buyer Learning Center

More for Business Sellers: