Florida

Not Disclosed

Cash Flow: $838,517

Florida

Not Disclosed

Cash Flow: $838,517

Lee County, NC

$62,500

Gta West, ON

$875,000

Dorchester County, SC

$175,000

Oakland County, MI

$140,000

Middlesex County, NJ

$125,000

New York, NY

$250,000

Suffolk County, MA

$1,050,000

Orange County, CA

$650,000

Cumberland County, ME

$695,000

Los Angeles County, CA

$1,350,000

REAL ESTATE INCLUDED

Raleigh, NC

Not Disclosed

Cash Flow: $349,005

Fort Lauderdale, FL

$400,000

Ohio

$3,500,000

Kennan, WI

$725,000

Los Angeles County, CA

$3,000,000

Charles Leduc

RoseBay International, Inc.

Serving Sarasota County, FL

As a Commercial and Business Agent at RoseBay International Realty, Inc., I help clients buy or sell their dream businesses in the restaurant industry. With over 20 years of experience in this role and 30 years of owning and operating various restaurants and businesses in the US and the Caribbean, I have a wealth of knowledge and expertise in every aspect of the business transaction process, from operations and design to branding and marketing. I am passionate about delivering exceptional service and value to my clients, whether they are seeking retirement, expansion, or a new venture. I understand the challenges and opportunities in the restaurant industry and I know how to ask the right questions and consider the right details to ensure a smooth and successful transition. I am a trusted partner and an asset to every business transaction, and I treat every deal as if it was my own.

Minnesota

$1,250,000

REAL ESTATE INCLUDED

Perry County, PA

$499,000

Washington

$640,000

Osceola County, FL

$175,000

Alaska

$8,500,000

Orlando, FL

$350,000

Addison County, VT

$175,000

Seminole County, FL

$700,000

Pompano Beach, FL

$990,000

Florida

$450,000

Wisconsin

$12,485,000

Las Vegas, NV

$299,000

Florida

Not Disclosed

EBITDA: $4,031,962

Boca Raton, FL

$15,400,000

Fairfield County, CT

$2,000,000

Lakewood, NJ

$45,000

REAL ESTATE INCLUDED

Tennessee

$1,500,000

Bridgeview, IL

$399,000

Not Disclosed

Cash Flow: $166,000

Beech Island, SC

$150,000

Kentucky

Not Disclosed

Cash Flow: $611,942

Canyon County, ID

$350,000

Los Angeles County, CA

$1,350,000

Cape Coral, FL

$50,000

Denver, CO

$450,000

Portland, OR

$285,000

Floyd County, GA

$150,000

Oregon

Not Disclosed

EBITDA: $4,425,360

Marla DiCarlo

BizNavigators LLC

Serving Denver County, CO

Ready to experience brokerage done differently? Step into the future of business brokerage with our groundbreaking new paradigm. A fresh new perspective that will change your expectations. We are pushing the boundaries of the industry, reimagining every aspect of the process to deliver unparalleled results. Say goodbye to traditional approaches and embrace a revolutionary way of buying or selling a business. Prepare to witness a new era in business brokerage, where innovation, efficiency, and exceptional service converge to create extraordinary opportunities. Discover a fresh approach to buying or selling a business that puts your needs at the forefront. Get ready to revolutionize your business brokerage experience. At BizNavigators, we understand that navigating the business world can be overwhelming. Whether starting a new business, buying or selling a company, or simply looking to grow and expand, our team of experts will help you chart a course to success. With our expert guidance and support, you can focus on what you do best - running your business - while we handle the navigation, providing the insight and experience you need to make informed decisions and achieve your goals. Don't get lost in the crowded marketplace. Let us help you navigate a clear path to a successful exit.

Orange Park, FL

$89,000

New Jersey

$575,000

Citrus County, FL

$150,000

Baltimore, MD

$300,000

Palm Beach County, FL

$40,000

Charleston, SC

$285,000

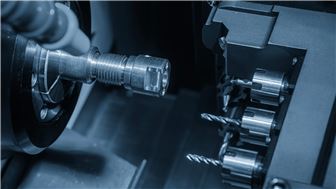

Companies that "make something" are always in demand, and U.S. manufacturing is growing, despite the decades long march towards offshore production. Some of the most popular categories include:

The manufacturing sector is resilient, and less affected by broader market trends. Asking prices and valuations have been steady through the pandemic years and continually command an average valuation multiple of 3 times seller earnings.

Whether you are considering buying or selling a manufacturing business, having some context is important for evaluating individual businesses relative to the market. To that end, we have aggregated business for sale listing data of manufacturing businesses, and surface key financial metrics and valuation multiples based on asking prices.

Market Overview

|

Number of Businesses Analyzed |

2,194 |

|

Median Asking Price |

$628,317 |

|

Median Reported Revenue |

$939,301 |

|

Median Reported Earnings |

$213,000 |

|

Financials based on businesses that listed an asking price, annual revenue, and seller's discretionary earnings. |

|

Manufacturing Business Valuation Multiples

|

Range |

Revenue |

Earnings (SDE) |

|

Lower Quartile |

0.50 |

2.40 |

|

Median |

0.75 |

3.12 |

|

Upper Quartile |

1.10 |

4.23 |

|

Revenue and earnings multiples based on reported revenue, seller's discretionary earnings, and asking price. |

||

Read the Report:

Manufacturing Business Valuation Benchmarks

FAQs

How much does it cost to buy a manufacturing business?

Prices vary depending on the size of the business listed, but the median asking price for a manufacturing business is $628,317.

How much do manufacturing business owners earn?

Manufacturing business owners report median annual sales of $939,301 and annual owner earnings of $213,000. These figures are based on businesses that have listed their annual revenue and seller's discretionary earnings.

How do I value a manufacturing business?

Valuing a manufacturing business involves considering several factors, including annual sales, profit, growth (or decline) trends, and demographic trends of the local market. Brokers, business owners, and business buyers will typically rely on valuation multiples to gauge business value relative to similar businesses in the market. Revenue multiples among manufacturing businesses listed for sale range from 0.50 to 1.10, with the median at 0.75. Earnings multiples range from 2.40 to 4.23, with the median at 3.12. These values suggest a typical manufacturing business in the U.S. may sell for around 0.75 times its annual revenue, and 3.12 times its annual owner’s earnings.

More for Business Buyers:

Set Up Alerts and Notifications

Business Buyer Learning Center

More for Business Sellers: